Continue from Ichimoku AI Trading System -- Part I

Knowing the limitation of what version 1 can do and adding in those concept that I wanted for the app, enhancement was made and eventually become version 2. New features for version 2 include having a 3rd option of instead just either perform Long or Short position, it will automatically switch between the two based on requirements or signals were triggered and this is the 3rd option LongShort. In the metrics showcase, those result from market will be computed so can be used as a comparison of how the strategy perform against the traditional market return (aka buy and hold strategy). If the strategy can't beat the market performance then it will be useless for this system. In the backtest result table, position type like Long or Short will be displayed so users can know what type of trade position was entered when using the LongShort option. In the chart display, "Enter" and "Exit" of position will be displayed on the chart on top of the usual entry and exit trigger signal. The most important enhancement for this version is none other than having the option to choose which combination set of Ichimoku signals to be used for Enter and Exit of position.

Ichimoku consists of Tenkan sen, Kijun sen, Senkou Span A, Senkou Span B (which form the cloud Kumo) and Chikou sen. Different combination of Ichimoku lines use will have different triggering criteria. Take the case of Tenkan sen crosses the Kijun sen which in normal indicate a buy signal but the position of these 2 lines with respect to the Kumo and also the behaviour of the Chikou sen can differentiate between a true or false buy signals. Similarly, combinations of the lines being used can be used to determine a true or false sell or stop loss situation. All these are taken from personal experiences from using the Ichimoku on real market trading and not from the SMU Ichimoku Technical Analysis course. Remember I was snubbed from the course !!! Version 1 of the app which can be easily found on the internet only uses 1 combination to swing between buy and sell signals and this is why the performance of it is so-so as detail in Part I. Same set of equities and trading periods were used for backtesting in version 2 as in version 1 so we can compared the result very clearly.

Above are the Long position for SGDJPY for periods from 1st Jan 2025 to 27th Feb 2025 using different combination of entry and exit signals. All outperformed the market and those in Version 1 despite during these periods SGDJPY is very bearish (market return is negative) and yet the system still able to achieve position return.

Above are the Short position for the same period and the total return despite all better than market and Long position, different combination of entry and exit signals also account for different return.

Above are using the LongShort option meaning system will automatically switch between Long and Short positions whenever the respective signal is being triggered. Again different combination of entry and exit signals produce different return. Without any doubts, the return is much higher than pure Long or Short position as it simply leverage on the market trend benefitting from both up and down of the market.

Now let look at what happen with SIA for the period 1st Jan 2020 to 27th Feb 2025, how Version 2 performs compared with Version 1 and market.

For pure long position, one of the entry and exit combination just fared slightly below market return but the other one beat it, not to mention both perform much better than Version 1. For longshort position, both combination of entry and exit just outperform market not just slightly but quite a very reasonable margin too. This is due to the capitalizing of the downturn during the Covid-19 period in take short positions and also along the way with those occasion pull backs.

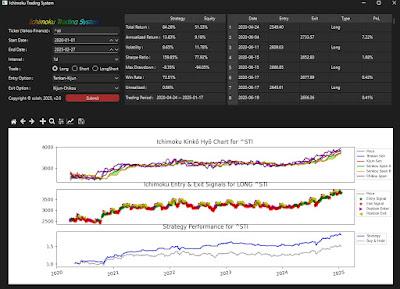

For STI it is the same case as in SIA whereby certain combination of entry and exit signal will outperform the market in either pure long or longshort position. Now come the most interesting and shocking part of the backtest even myself almost fell off the chair after looking at the result. This is the case for Bitcoin.

The first test show the entry and exit combination that performed slightly below market return. However, when it was switched to another combination of entry and exit, it outperforms market return (3,211.35% vs 1,899.36%, that 69% more). As we know BTC is very volatile and price swing is wild so the next test is adopting the longshort option to try to take advantage of both the up and down movement of the price. The first combination of entry and exit is 2,330.49% vs 1,899.36% in term of return, just a mere 22.7% better, However, when I switched to another combination of entry and exit, the result becomes 10,711.44% vs 1899.36%, that is 463.95% more !!!!. The final one is another combination of entry and exit. If the previous test that outperformed 463.95% gave me a shock, this one made me almost fell off the chair. The return was 144,681.03% vs 1,899.36%, that is 7,517.36% more !!!. WHAT THE HACK !!!!

So with the app and after running several backtests, it pretty much confirm to what I have personal experienced and believed that each individual will have a unique combination of entry and exit signals based on the Ichimoku components that suit it best. The Ichimoku technique is pretty much very versatile in the sense that its several components can act in different combination to produce the trigger signal (buy or sell). If without this app that I could use the backtest to check it out, I will never know which combination sets of entry and exit work best for that equity.

This is not the final version for this program as there will be an AI integration to it which am currently developing. Whether the integrated AI features can further improve the performance or not, I believe it doesn't really matter as from those backtest results whatever I am having now is pretty much good already. The integrated AI is like a challenge to myself now, from an nobody who know very little about AI to get to know what AI can and will do through the concept I have on the program.

So, am I not wrong to say I am very grateful for SMU snobbish act of snubbing me from the Ichimoku Technical Analysis course as without that I wouldn't achieve what I am having now.