Opened a CPF Investment Account (CPFIS) in 2006 and in the early part of it was used as short-term trading. It was only until 2008 then I decided to start long-term investing with it. Presently, I still occasionally use CPFIS as short-term trading.

In the early days I got mixed performance using CPFIS as short-term trading and the followings were the stocks that I have traded on since 2006.

1. Allgreen (already delisted in 2011)

2. HG Metal

3. K1 Venture

4. NOL

5. Saizen Reit

6. Mapletreelog

7. Ascendas Reit

8. Swiber

9. Plife

10. SIA Engg

11. UMS

12. United Engineers

13. Ho Bee

14. SingPost

15. Frassers Cpt

Of the above, those highlighted in blue indicating realizing a profit for it while those in the red were realizing a loss for it.

The investment portfolio that I started in 2008 till now consists of the following stocks :-

1. STI ETF (since 2008)

1.1 STI ETF (2015) -- Divested

2. First REIT (since 2009)

In the early days I got mixed performance using CPFIS as short-term trading and the followings were the stocks that I have traded on since 2006.

1. Allgreen (already delisted in 2011)

2. HG Metal

3. K1 Venture

4. NOL

5. Saizen Reit

6. Mapletreelog

7. Ascendas Reit

8. Swiber

9. Plife

10. SIA Engg

11. UMS

12. United Engineers

13. Ho Bee

14. SingPost

15. Frassers Cpt

Of the above, those highlighted in blue indicating realizing a profit for it while those in the red were realizing a loss for it.

The investment portfolio that I started in 2008 till now consists of the following stocks :-

1. STI ETF (since 2008)

1.1 STI ETF (2015) -- Divested

2. First REIT (since 2009)

2.1 First REIT (2020) -- Divested

3. Kepland (since 2015)

3.1 Kepand (2015) -- Privatized

4. OCBC (since 2015)

3. Kepland (since 2015)

3.1 Kepand (2015) -- Privatized

4. OCBC (since 2015)

4.1 OCBC (2021) -- Strategic Action

5. FrasersCom Trust (since 2015)

5.1 FrasersCom Trust (2019) -- Divested

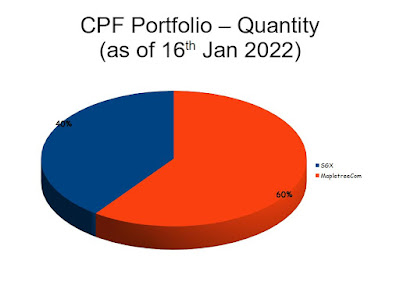

6. MapletreeCom Trust (since 2020)

5. FrasersCom Trust (since 2015)

5.1 FrasersCom Trust (2019) -- Divested

6. MapletreeCom Trust (since 2020)

7. SGX (since 2021)

Technically speaking the very first stock I have in my CPF was SingTel A and B shares and those were like more than decade ago in which I eventually divested in 2007 with a very good gain (can't remember exactly how much gain it was though).

Objective :-

1. To meet the unexplainable forever increasing minimum sum

2. To offset that pitiful small amount of interest rate provided by CPF Board

3. Wealth creation

Requirement :-

1. Fundamentally strong stocks

2. Stocks must offer both dividend yield and capital appreciation

3. Dividend yield must be higher than what CPF Board can offer

Technically speaking the very first stock I have in my CPF was SingTel A and B shares and those were like more than decade ago in which I eventually divested in 2007 with a very good gain (can't remember exactly how much gain it was though).

Objective :-

1. To meet the unexplainable forever increasing minimum sum

2. To offset that pitiful small amount of interest rate provided by CPF Board

3. Wealth creation

Requirement :-

1. Fundamentally strong stocks

2. Stocks must offer both dividend yield and capital appreciation

3. Dividend yield must be higher than what CPF Board can offer