Continued from STI Analysis -- the next peak and trough ? (112)

FTSE STI closed 3,394.21 on 27th Jan 2023 edging up since the start of the year.

Magenta -- STI Positive

As mentioned previously, this scenario presents 2 possible wave counts. With STI moving towards the previous heigh of 3,466.23, this does look like the wave count bias towards the case 2 in which STI is in Intermediate wave ((v)) of Primary wave 1. However, do note that case 1 (STI is in Primary wave 2 doing the Intermediate wave ((b)) ) is yet to be invalidated. Even though STI moves above 3,466.23 going forward, this still yet to invalidate case 1. This is because in EW corrective wave, there is a structure called Expanded Flat (3-3-5 pattern) whereby the wave B terminates beyond the starting level of wave A, typically 123.6% of wave A.

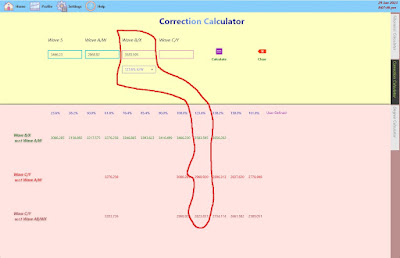

Above is the calculated value generated from the Corrective Calculator of the Elliott Wave Calculator. With wave B at 123.6% of wave A, that will give STI a value of 3,583.59 and a possible downside of between 2,823.85 to 2,589.05 for wave C ( 123.6% - 161.8% of wave AB ).

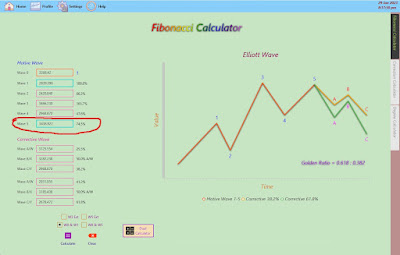

Above is the generated value of Intermediate wave ((v)) of Primary wave 1 ( case 2 ) and somehow doesn't look optimistic either. Firstly, the estimated ending value of Primary wave 1 is at 3,438.92, which is like 44 points from the closing on 27th Jan 2023. Note that, it is possible STI move beyond that when it doesn't follow the golden ratio of 0.618 : 0.382. Secondly, what's following after Primary wave 1 is the deep correction of Primary wave 2.

The positive scenario is optimistic on the longer term but pessimistic on the short term.

Green -- STI Negative

The STI negative scenario is not affected by the recent upwards movement of the STI as it is part of the B wave of the corrective movement.

Above is the overall wave count for both the positive and negative scenario since 1997.

On global economy perspective, many are just looking at whether will it goes into recession and how deep will it be. Unfortunately, most are looking at the wrong thing. It is stagflation that one should be concerned about. With inflation at elevated level, economy growth stalls and coupled with high unemployment rate, this is the mega killing thing and can take few decades to get over with. If neglecting this and it will become deep-rooted and policy makers will have a tough time to recover from it as any of the policies can rescue at most 2 of the 3 issues but sending the 3rd to the extreme.

Tiger Brokers Singapore Invitation Code

Singapore Covid-19

主将无能垮三军

左士缺策只砸钱

右士辱人自被辱

左象无计只会泣

右象理人理出祸

左马略识色不分

右马讲据终慢拍

小卒仗权乱闹事

大敌当前夸本领

火烧眉头方才悟

城门紧闭称闭窗

高傲自大多借口

知错不认真懦夫

领导者最佳战友

为何小红点缺乏

是否无勇气拥有

是否缺远见拥有

是否不知怎拥有

还是不想去拥有