Continued from STI Analysis -- the next peak and trough ? (116)

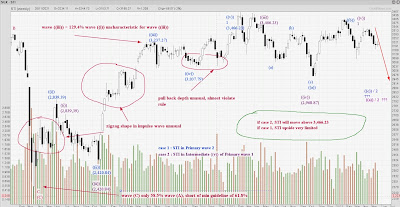

FTSE STI closed at 3,207.39 on 26th May 2023, practically unchanged for the whole week.

Magenta -- STI Positive

Despite look like a rebound is coming, the EW count for this positive scenario still largely remain the same. For case 1 in which STI is in Intermediate ((c)) of Primary wave 2, the trajectory remain on course for further downside before Primary wave 2 ends. However, for case 2 in which STI could still be in Intermediate wave ((v)) of Primary wave 1 is still possible (lower possibility than case 1). This case is true if the rebound for the next couple of weeks allow STI to move above peak of Intermediate wave ((iii))) -- 3,466.23 so as to complete the Primary wave 1. Regardless which case, STI still yet to hit the bottom of Primary wave 2.

Green -- STI Negative

Largely expected, there shouldn't be any major movement in this scenario in term of EW count. For this scenario, STI is in Primary wave A of Cycle wave (C) of SuperCycle wave ((C)). Looking the perspective from time duration, the downward bias or bottom of SuperCycle wave ((C)) could drag for another 1 to 3 years.

Above is the overall picture for STI EW count for both the positive and negative scenario from 1994 till now.

Final Thought

On 25th May 2023 according to data, Germany has entered into recession after 2 consecutive quarters of GDP contraction. 2022 Q4 was hit with a 0.5% contraction and 2023 Q1 was 0.3% contraction. Though what it looks like was a shallow recession, Germany probably became the first nation in the world to enter recession now. Other nations include US are not spared too going forward. Majority of the policy makers and economists are just solely focusing on whether will or will not enter recession but forgetting the bigger picture. The elevated inflation couples with high interest rate is a big shark in the waiting to swallow the world economic situation. It is not a question of recession any more, it is a question of stagflation should inflation remains at a elevated level and high interest rate for a prolong period of time. To avoid that, Central Bankers should not miss the window of opportunity to curb the inflation down to an acceptable level with tightening rather than trying the avoid recession and either halt or slow down in tightening. If stagflation does occur, this can easily develop into decades long or even a century long of problem for the world.

Tiger Brokers Singapore Invitation Code

Singapore Covid-19

主将无能垮三军

左士缺策只砸钱

右士辱人自被辱

左象无计只会泣

右象理人理出祸

左马略识色不分

右马讲据终慢拍

小卒仗权乱闹事

大敌当前夸本领

火烧眉头方才悟

城门紧闭称闭窗

高傲自大多借口

知错不认真懦夫

领导者最佳战友

为何小红点缺乏

是否无勇气拥有

是否缺远见拥有

是否不知怎拥有

还是不想去拥有